What is Medicare?

Medicare is a federal program that provides health insurance for people who are 65 or older, certain younger people with disabilities, and people with End-Stage Renal Disease. There are 4 parts to Medicare.

What are the 4 Parts of Medicare?

Part A: Inpatient care, hospitalizations

Part B: Outpatient care, doctors’ visits

Part C: Medicare Advantage

Part D: Prescription drugs coverage

Enrollment and Choosing Medicare Plans

When and how to enroll in Medicare

Choosing a Medicare Advantage plan

Understanding Medicare Supplementals

Frequently Asked Questions

What is the Part D “Donut Hole”?

What is “Extra Help”?

Does Medicare cover Long-Term Care?

Does Medicare cover dental and vision?

Medicare Part A Covers Inpatient Care

Inpatient hospital care

Covered for up to 90 days of each benefit period and up to 60 lifetime reserve days.

In 2023, beneficiaries must pay a coinsurance amount of $400 per day for the 61st through 90th day of a hospitalization. For each lifetime reserve day, you have to pay coinsurance ($800 per day in 2023).

Lifetime reserve days can only be used once.

Skilled nursing facility care

Covered for up to 100 days for each benefit period. Medicare covers room, board, and services at a SNF.

To qualify for this coverage you must spend 3 days in inpatient care at a hospital within 30 days prior to admittance to a SNF.

Home health care

Covered for up to 100 days of daily care or unlimited intermittent care.

To qualify for this coverage you must spend 3 days in inpatient care at a hospital within 14 days prior.

Hospice care

For each lifetime reserve day, you have to pay coinsurance ($800 per day in 2023).

The 2023 Medicare Part A deductible for each benefit period is $1,600.

Medicare Part B

Covers 80% of Outpatient Care

- Provider services: Medically necessary services from licensed health professionals.

- Durable medical equipment: e.g. walkers, wheelchairs.

- Home health services: Covered if you are homebound and need skilled nursing/therapy.

- Ambulance services: If medically necessary.

- Preventative services

- Screenings and counseling. Usually covered in full.

- Therapy services: Physical, speech and occupational therapy.

- Mental health services

- X-rays and lab tests

- Chiropractic care: When medically necessary.

- Select prescription drugs: Drugs that are typically administered by a physician

The 2023 Part B Premium is $164.90 a Month

Medicare Part C

Also known as Medicare Advantage, Medicare Part C plans help balance cost and coverage. They are administered by private insurance companies.

Original Medicare (Parts A and B) provides inpatient and outpatient coverage. However, the cost without supplemental coverage may be prohibitive depending on your needs. Medigap and Medicare Part C plans are two ways to lower that cost.

Part C plans are similar to employer plans. The most common are: Health Maintenance Organizations (HMOs), Preferred Provider Organizations (PPOs), and Private Fee-for-Service (PFFs).

Typically, Part C plans include a limit on your out-of-pocket expenses for Part A and Part B. Many Part C plans also include drug coverage. And, some Part C plans offer extra coverage for vision, dental, hearing, and wellness programs.

To learn more about Medigap, click here.

Part C (Medicare Advantage) is NOT the same as Medicare Supplemental (Medigap)

Medicare Part D

Part D Plans FAQs

- Helps Reduce the Price of Prescription Drugs

- Are administered by private insurance companies

- Cover most outpatient prescription drugs

- Are offered as a stand-alone plans for Original Medicare enrollees

- Are often included for Part C enrollees

Most people should enroll in Part D when they first get Medicare. Delayed enrollment may result in gaps in coverage and enrollment penalties.

It’s also important to be aware that Part D plans have a coverage gap (also known as the “Donut Hole”). The coverage gap starts when you and your insurance company spend $4,020 on medications and ends when you spend $6,350. Click here to learn more about Part D and the Donut Hole.

Depending on your income, you may qualify for federal or state programs that help further reduce the cost of medications. The federal program is called Extra Help.

When to enroll

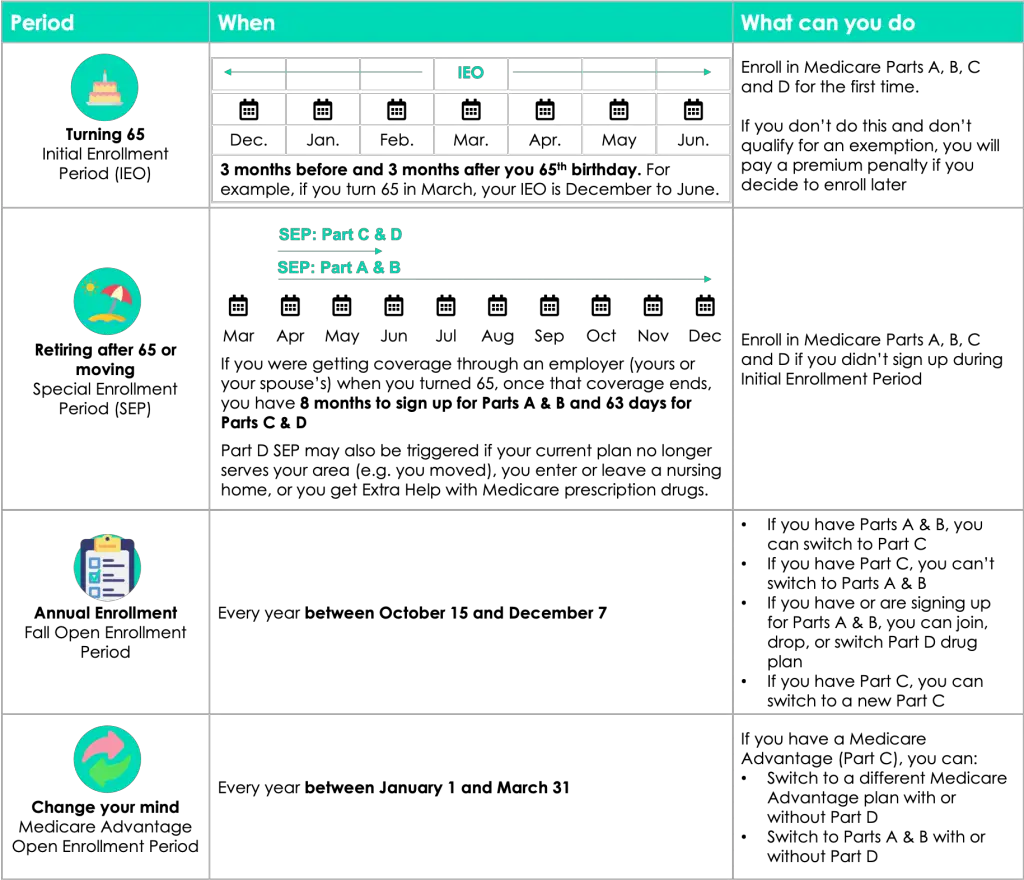

There are four enrollment periods.

You can find plans that are available in your area by visiting Medicare.gov.

Initial Enrollment Period (IEP)

An IEP starts 3 months before your 65th birthday and ends 3 months after.

Special Enrollment Period (SEP)

An SEP is triggered when your circumstances change. For example, you moved states or retired and lost coverage through your employer.

Annual Enrollment Period (AEP)

An AEP occurs every year in the fall (from October to December). During this period, it is strongly recommended that you review your Medicare coverage to make sure it still suits you.

Medicare Advantage Open Enrollment (MAOE)

An MAOE follows the AEP. During this period you may adjust the choices you made during the AEP.

If you don’t sign up for Medicare Part B when you’re first eligible, your coverage may be delayed and you will pay a lifetime penalty when you do get Part B.

How to enroll

If you do not receive Social Security or Railroad Retirement Board (RRB) benefits, you’ll need to sign up for Original Medicare. You can do so in 3 ways:

- Online: at SocialSecurity.gov.

- By phone: call Social Security at 1-800-772-1213 (TTY users 1-800-325-0778), Monday through Friday, from 7AM to 7PM.

- In-person: at your local Social Security office.

If you receive Social Security or Railroad Retirement Board (RRB) benefit, you will be enrolled automatically.

You should consider your health needs and budget when choosing a plan. If you need help, consult a Medicare broker.

How to Choose a Medicare Advantage Plan?

Choosing among Medicare Advantage plans can be confusing: premiums, deductibles, prescription gap coverage – how do you make sense of them all!? Below are 6 steps to help you choose a plan that meets your needs and budget.

Step 1: Identify plans available in your area

The government’s website Medicare.gov lists all available plans by zip code

Step 2: Identify plans that are accepted by your doctors

Each Medicare Advantage plan has a list of providers in its network. This list is usually available on the plan’s website. The lists are not always up-to-date. Listed doctors may take the plan, but not take new patients. You may also see doctors who used to, but no longer take the plan. If you want to be 100% sure your doctors take the plan, call the doctors and verify with them directly.

Step 3: Research whether your prescriptions are covered

Each Medicare Advantage plan with prescription coverage (MAPD) has a list of prescriptions that it covers. This list is called a formulary.

The formulary spells out which prescriptions are covered and at what rate. Coverage among plans varies. This means that your total annual cost can differ significantly by plan.

Step 4: Determine whether you care about vision, dental or any of the non-medical services provided by the plan

Some Medicare Advantage plans provide vision and dental coverage. Typically, for an additional fee.

Medicare Advantage plans are increasingly covering non-medical services: transportation, meals, fitness benefits, over-the-counter drugs, in-home support services, telehealth and safety equipment. If any of these services are important you, check whether they are covered.

Step 5: Consider your lifestyle (do you spend part of the year outside your primary residence?)

Similar to employer plans, Medicare Advantage plans are available as HMOs and PPOs. In short, Healthcare Management Organization (HMOs) plans tend to be cheaper, but limit provider choice. Preferred Provider Organization (PPOs) are more expensive, but allow you to choose providers more freely.

Both HMOs and PPOs limit your provider choice geographically.

Medigap plans are less restricting geographically and may be the right option if you spend a lot of time outside your primary residence.

Step 6: Calculate approximate annual cost

It is impossible to predict your exact annual cost. How much you’ll spend on healthcare will depend on which medical services you use and which prescriptions you take throughout the year. However, you can calculate approximate cost by assessing your health and tallying up your spend on prescriptions.

Doctors’ visits: each plan has a copay amount specified for a primary doctor’s visit and for a specialist doctor’s visit. Every time you visit the doctor, you will pay this copay amount. For most plans, copays range from $0 to $50 per visit. If you go to the doctor a lot, these copays can add up.

As explained above, each plan has a formulary that determines the price of medications it covers. To calculate the annual cost of your prescription medications: make a list of all your medications and use the plan’s formulary to identify which tier they fall into (and thus, their cost for every month of the year).

Medicare Supplemental Plans

Answers to 7 of the most common questions about Medicare Supplemental plans.

1. Is Medicare Supplemental Insurance the same thing as Medigap?

Yes, Medicare Supplemental and Medigap are two terms that can be used interchangeably.

However, be careful not to confuse Medicare Supplemental / Medigap and Medicare Advantage. Medicare Advantage is different.

2. Why do people get Medicare Supplemental Insurance if they already have Medicare?

Medicare Parts A & B (Original Medicare) help cover the cost of inpatient and outpatient care. However, you’re still left with sizable copays, coinsurance payments, and deductibles. For example, Original Medicare only covers 80% of a doctor’s visit. For this reason 4 out of 5 people on Original Medicare have supplemental coverage either through retiree benefits, Medicaid, or individually purchased Medicare Supplemental Insurance.

3. What does a Medicare Supplemental Insurance cover?

There are currently 10 federally standardized Medicare Supplemental plans (A, B, C, D, F, G, K, L, M, N)*. This means that the coverage you receive under each plan is identical no matter from which private insurance company you purchase it.

4. Am I eligible to buy Medicare Supplemental coverage?

To be eligible for Medicare Supplemental coverage you must be: 65 or older or be diagnosed with End Stage Renal Disease or ALS or enrolled in Original Medicare (Part A & B).

You’re guaranteed to be accepted into a Medicare Supplemental plan during your Medigap Open Enrollment Period (for 6 months after the first day of the month that you’re both 65 years old and enrolled in Medicare Part B.)

5. How do insurance companies determine how much to charge me for a Medicare Supplemental plan?

In most states, the monthly premium of your Medicare Supplemental plan depends on the plan, your health, where you live, and from which insurance company you purchase the plan.

The plan: the more coverage a plan provides the more expensive it will be. For example, a Plan G (which covers almost everything) will typically be more expensive than a Plan A.

Your health: insurance companies can require you to go through medical underwriting before accepting you into their plan. Poor health can lead to higher premiums. However, they are required to accept you during the Medigap Open Enrollment Period. This period begins on the first day of the month that you’re both 65 years old and enrolled in Medicare Part B.

Where you live: premiums for the same plan from the same carrier differ by zip code.

Good news for New York State residents! The only thing that matters in New York is where you live. Insurance companies are required to accept you into any Medigap plan regardless of your health status or when you choose to enroll.

6. How do I choose which Medicare Supplemental plan is right for me?

First choose a letter

Plan F offers the most coverage: if Original Medicare covers a service or procedure, you will pay nothing.

Plan G is the same as Plan F, but you will have to meet your Medicare Part B deductible before the plan’s coverage kicks in.

Plan C is the same as Plan F, but it doesn’t cover excess charges. Medicare allows doctors to charge up to 15% more than the Medicare agreed upon price. If you see a doctor who has excess charges, you will have to pay these excess charges out-of-pocket under Plan C.

Similarly, Plan D is the same as Plan G, but it doesn’t cover excess charges.

Plans A and B do not cover skilled nursing facility coinsurance.

Plans K and L have a 50% (K) and 75% (L) coinsurance for most services. Because you will be paying for most outpatient services, both K and L plans have out-of-pocket maximums.

Plan M only covers 50% of the Part A deductible. This could be costly if you end up having major inpatient services.

Plan N is similar to Plan G, but you will pay $20 for each doctor’s visit.

Then choose a carrier

Carriers are not required to offer all plans. So check which plans are offered by which carriers in your zip code. Then, compare prices. Because coverage benefits are standardized, price is the biggest consideration factor. Another factor to consider is the quality of customer service.

7. Does Medicare Supplemental cover prescription drugs?

No. Medicare Supplemental does not cover prescription drugs. You have the option to purchase a Part D Prescription Coverage plan to help pay for the cost of drugs. It is highly recommended that you enroll in a Part D plan as soon as you’re eligible. If you do not, you will pay a late enrollment penalty and may have a gap in coverage.

What is the Part D “Donut Hole”?

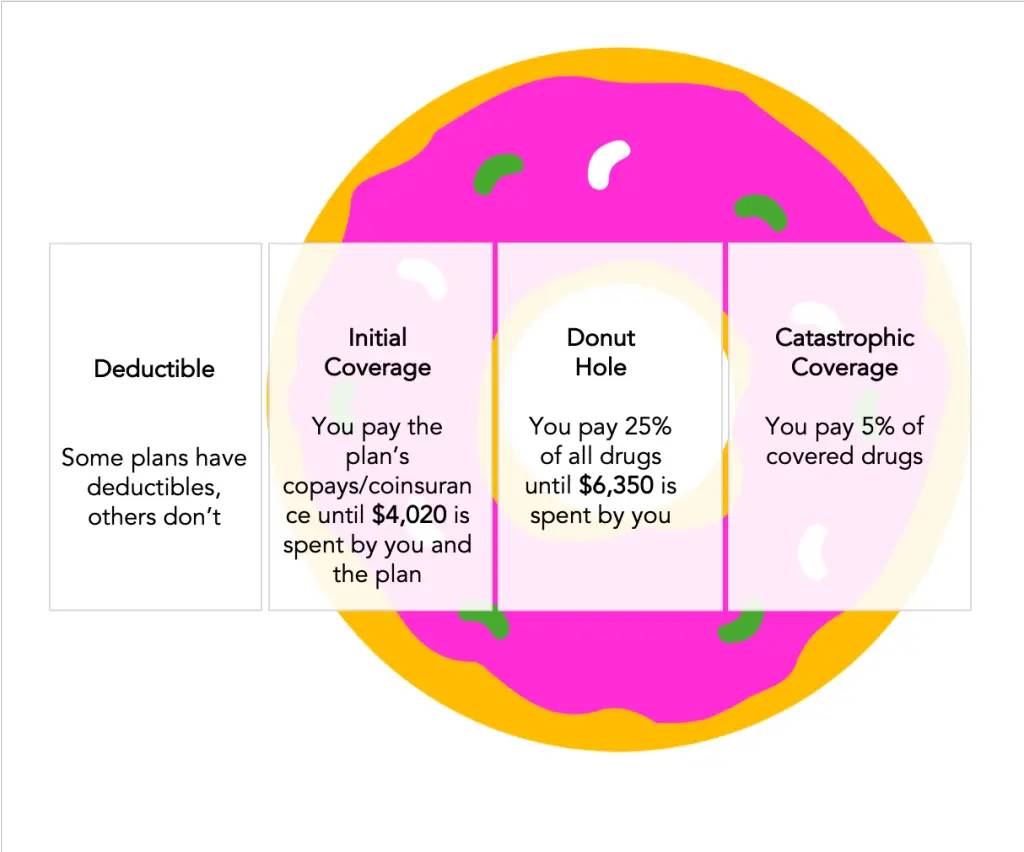

There are 4 coverage phases for Part D plans.

Phase 1: Deductible

Some, but not all, Part D plans have a deductible. The deductible can be anywhere from $0 to $505 (in 2023). Every year, you must first meet the deductible before moving onto the second coverage phase– the Initial Coverage. This means you pay the full cost of your prescriptions until the deductible is met.

Phase 2: Initial Coverage

Each Part D plan sets its own copays and coinsurance rates for generic and brand name drugs by tier. You will pay these fees until you and your plan spend a total of $4,020.

Phase 3: The Donut Hole (Gap Coverage)

During this phase you will pay 25% of all generic and brand name drugs until you spend $6,350.

In previous years, the gap was significantly larger. Medicare has narrowed the gap over last few years. However, 25% of an expensive drug can still be a large monthly expense.

Many seniors qualify for additional subsidies. The federal government program aimed at helping seniors reduce the cost of drugs is called Extra Help. Each state has its own additional program. The New York State program is called EPIC (Elderly Pharmaceutical Insurance Coverage).

Individuals with income less than $75,000 or married couples with income under $100,000 qualify.

Phase 4: Catastrophic Coverage

In this phase, you will pay 5% of all covered drugs.

What is “Extra Help”?

Medicare Part D, administered by private insurance companies, provides prescription drug coverage for Medicare enrollees. Extra Help is a federal program that helps pay Part D premiums, copays and coinsurance costs.

Eligibility

If you are enrolled in Medicaid, Social Security Income (SSI), or Medicare Savings Program (MSP), you automatically qualify for Extra Help. If you are not enrolled in one of these programs, you must meet income and assets eligibility requirements.

For Full Extra Help, your monthly income must be under $1,425 (or $1,922, for couple) and your assets must be under $9,230 (or $14,600 for couples). For Partial Extra Help, your monthly income must be under $1,581 (or $2,134, for couple) and your assets must be under $14,390 (or $28,720 for couples).

Benefits

Full Extra Help

- Premium: You pay no premium if you have Full Extra Help and a basic Part D drug plan with a premium at or below the Extra Help premium limit for your area

- Deductible: $0

- Copayments: $3.65 for generic drugs, $8.95 for brand name drugs, $0 after you reach out-of-pocket maximum of $6,350

Partial Extra Help

- Premium: Premium depends on your income

- Deductible: $85 or the plan’s deductible, whichever is lower

- Copayments: 15% coinsurance or the plan copay, whichever is lower. After you reach out-of-pocket maximum of $6,350, $3.65 for generic and $8.95 for brand name or 5% of drug cost, whichever is higher

- Enrolling in Extra Help eliminates any Part D late enrollment penalty and qualifies you for a Special Enrollment Period (SEP). During SEP you can enroll in a Part D or Medicare Advantage plan.

Enrolling

If you are enrolled in Medicaid, Social Security Income (SSI), or Medicare Savings Program (MSP), you will be automatically enrolled in Extra Help. You will receive a purple-colored notice from CMS notify you of your enrollment.

Otherwise, you can apply online through the Social Security Administration website.

Does Medicare Cover Long-Term Care?

Medicare does not cover long-term care (assistance with activities of daily living). In some circumstances, Medicare covers skilled nursing care, home health care, and hospice care.

One of the biggest misconceptions about Medicare is that it covers long-term care (LTC). Many individuals are shocked to learn that they have to pay for LTC out-of-pocket unless they planned ahead or qualify for Medicaid.

What is Long-Term Care exactly?

Long-Term Care is care that you need to perform activities of daily living. Activities of daily living include: bathing, dressing, dressing, grooming, using the toilet, eating, getting out of bed, etc. Long-Term Care can be performed in-home, in the community (adult day care) or at a facility (assisted living or nursing home).

How much does Long-Term Care cost?

According to a report published by Genworth in 2021, the national average for:

- In-home care is over $4,957 per month

- Adult day care is $1,690 per month

- Assisted living is $4,500 per month

- Nursing home is $7,908 per month (semi-private), $9,034 per month private

What does Medicare cover?

In some circumstances, Medicare will cover skilled nursing care, home health care and hospice care.

Skilled Nursing Care

Medicare pays for your recovery in a skilled nursing care facility after a three-day hospital stay. The first 20 days are fully covered. For the next 80 days, you’ll pay $200 coinsurance per day (in 2023). After 100 days, Medicare stops paying for skilled nursing care.

Home Health Care

If you are homebound and a doctor says you need short-term skilled care, Medicare will pay for nurses and therapists to provide services in your home.

Hospice Care

Medicare pays for hospice care. Hospice care is support for terminally ill patients in their last stage of life. The focus of hospice care is quality of life and comfort, not cure. Medicare will pay for hospice care as long as your doctor says you are terminally ill.

How Can I Get Long-Term Care Coverage?

Unlike Medicare, Medicaid covers the cost of long-term care. To qualify for Medicaid, you have to meet state specific income and savings requirements. Since Medicaid is a state-run program, Long-term care benefits vary by state.

Generally, Medicaid will cover the cost of nursing homes. Although, many nursing homes do not accept Medicaid patients. In most states, Medicaid will not cover the cost of in-home care or adult day care. New York is one of the few states where Medicaid will cover in-home care and stays in assisted living facilities.

Long-Term Care Insurance is coverage you can purchase from a private insurance company. Traditional LTC policies provide a fixed daily benefit for nursing home care and limit the benefit period to 3 years. The premium for an LTC policy can change over time. Recently, premiums have been increasing. As a result, fewer and fewer people are buying traditional LTC insurance.

Whole life insurance is an alternative type of long-term care coverage. Whole life insurance will return money to your heir if you don’t end up using long-term care. Additionally, you are able to lock-in the premium rate upfront.

Some Medicare Advantage plans are beginning to offer limited long-term care coverage. It’s worth checking if there are any plans in your area that do.

Seniors can also use reverse mortgages or qualify for VA benefits that can help pay for long-term care.

Does Medicare Cover Dental and Vision?

Original Medicare does not cover routine dental and vision. Some Medicare Advantage plans provide routine dental and vision coverage. Individuals with Medicare Supplemental plans who want dental and vision coverage can purchase stand alone policies.

Dental

Medicare does not cover most:

- Dental care

- Dental procedures

- Supplies

- Cleanings

- Fillings

- Tooth extractions

- Dentures

- Dental plates

- But, Medicare Part A (Hospital Insurance) will pay for certain dental services that you get when you’re in a hospital.

Vision

Medicare does not cover eye exams (sometimes called “eye refractions”) for eyeglasses or contact lenses. You pay 100% for eye exams for eyeglasses or contact lenses.

However, Medicare Part B covers eye screening in some circumstances:

- If you have diabetes, Medicare Part B covers eye exams for diabetic retinopathy once a year.

- If you’re at a high risk for glaucoma, Medicare Part B covers glaucoma screening once a year. You’re considered high risk if you have diabetes, have a family history of glaucoma, are African-American and over 50, or are Hispanic and over 65.

- If you have age-related macular degeneration (AMD), Medicare Part B may cover certain diagnostic tests and treatment (including treatment with certain injected drugs) of eye diseases and conditions.

Options for getting dental and vision coverage

Individuals who are on Original Medicare and individuals who have a Medicare Supplemental can purchase a standalone dental and/or vision coverage from a private insurance company. These plans typically have a monthly premium and a maximum benefit amount.

Another option is a dental discount plan. A dental discount plan is not insurance. Dentists participating in discount plans agree to offer discounts for certain services. Usually, this is a percentage of the total amount.

Medicare Advantage plans (Medicare Part C) often provide routine dental and vision coverage.